New data shows that the speculation and vacancy tax helped turn more empty units into homes in 2023.

More than 99% of property owners who live in B.C. remained exempt from the tax in its sixth year.

The majority of revenue came from non-B.C. residents.

Money raised from the tax goes directly toward affordable homes in the regions where the tax applies. In 2023, $75.2 million was raised by the tax.

In 2023-24, the B.C. government invested $1.8 billion toward housing in the specified areas.

Principal residences and residences occupied by a tenant remained the top two exemptions claimed by property owners in 2023, suggesting the tax continues to encourage the use of residences for long-term housing.

The speculation and vacancy tax is part of B.C.’s Homes for People plan that includes actions to fight speculation and profiteering, provide more affordable homes and speed up delivery of new housing.

To learn more, visit Government of British Columbia.

Filberg Park Awarded Special Accreditation

Filberg Park Awarded Special Accreditation

Sportsplex Closed Wednesday For Repairs

Sportsplex Closed Wednesday For Repairs

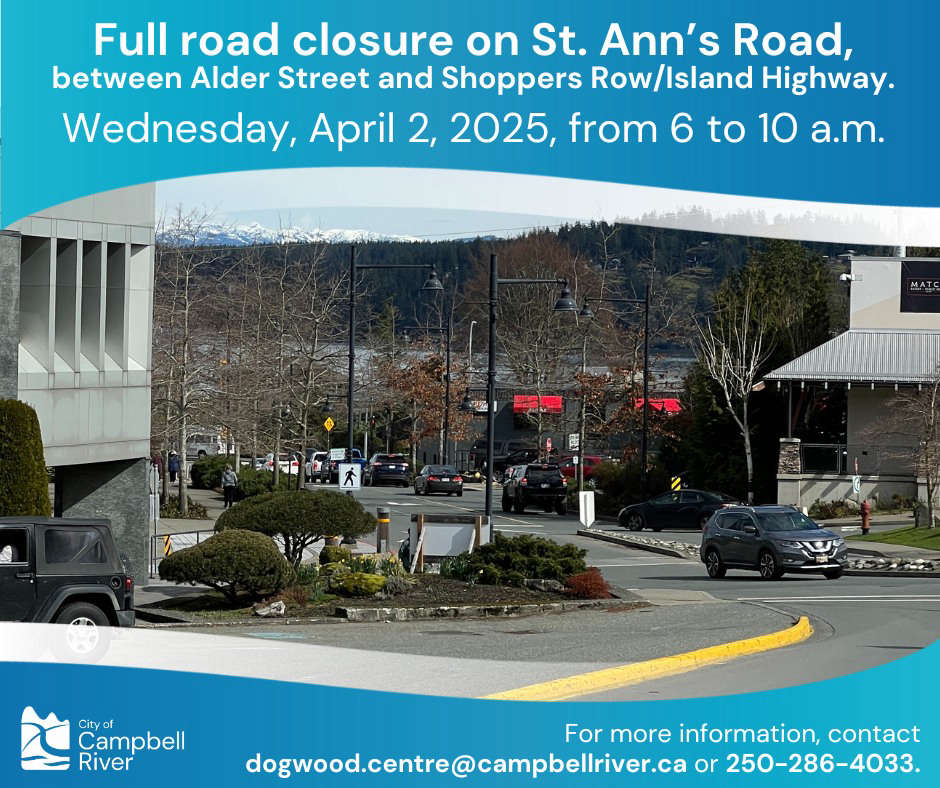

St. Ann’s Road Closure Today

St. Ann’s Road Closure Today

Strathcona Regional District Approves 2025-2029 Financial Plan

Strathcona Regional District Approves 2025-2029 Financial Plan

Comox Valley Talks Recreation

Comox Valley Talks Recreation